Pref vs. Mezz

Preferred equity (Pref) and mezzanine debt (Mezz) are financing options used by real estate investors to fill gaps in the capital stack.

Similarities:

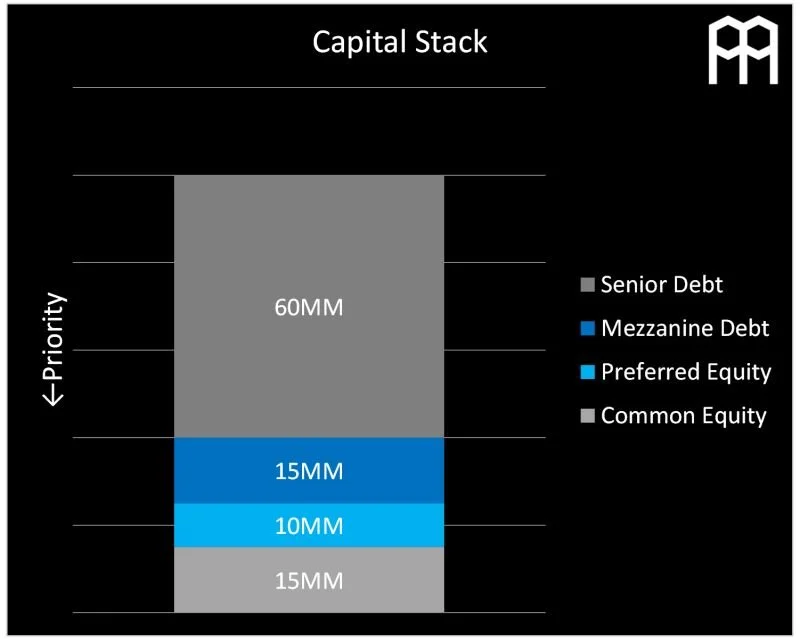

Position in the Capital Stack: Pref and Mezz are subordinate to senior loans and hold priority over common equity.

Pricing: Similar to their position in the capital stack, both are more expensive than senior debt, typically ranging from 8-15% annually on invested capital.

Differences:

Mezzanine debt is a loan, usually backed by a lien on the property (with senior debt approval) or a pledge of ownership interests. This allows Mezz lenders to take control of the ownership stake if the borrower defaults, giving them a pathway to recover their investment.

Preferred equity is an investment in the operating entity that owns the real estate. If specific targets such as minimum returns or performance goals aren’t met, Pref investors are granted control rights. This includes the ability to replace existing management and other key decisions to protect their equity.

Below is an example $100MM capital stack with repayment priority in ascending order. While these distinctions are typical, each term sheet varies by deal.