Impact of Extreme Weather Events

Extreme weather events have nearly doubled over the past 20 years. Here’s how climate risks are reshaping insurance costs in the industry:

Record-Breaking Losses: In an article published by Fannie Mae, the U.S. faced 28 separate billion-dollar extreme weather events in 2023, with recovery expenses reaching a record $92.9 billion. This heightened risk has led some insurers to scale back coverage and increase prices.

Rising Insurance Costs: According to Yardi Matrix, the average annual insurance premium for multifamily communities rose 75% from $280/unit in 2018 to $490/unit in 2022.

Impact: Landlords facing rising ownership costs are raising rents to offset higher insurance rates, further widening the affordability gap. As financial feasibility for new developments declines, supply shortages will persist.

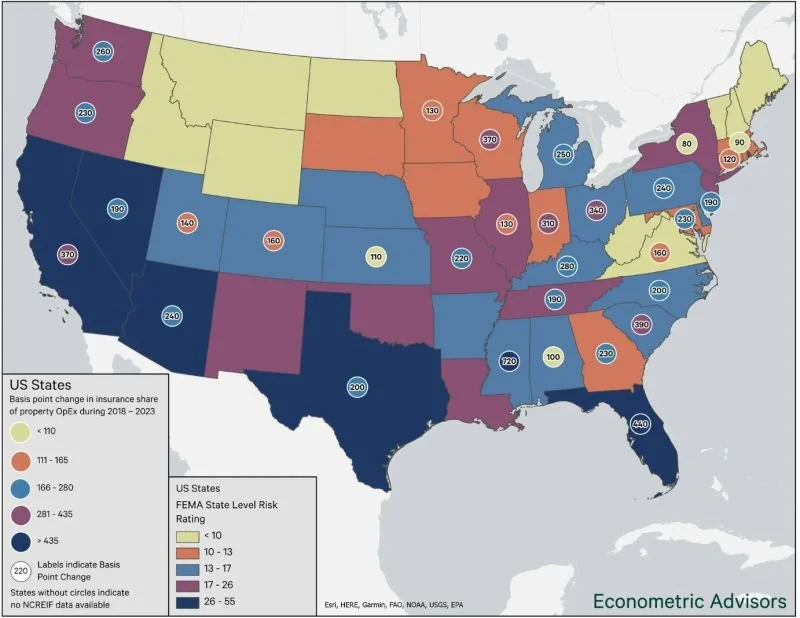

The map below, from CBRE, illustrates the basis-point increase in insurance costs as a share of total operational expenditures, showing the sharpest rises in states with high FEMA risk levels.

CBRE link: https://lnkd.in/g5DrMFsM

Fannie Mae link: https://lnkd.in/gq8bxEsZ