GP Catch-Ups (Partnership Waterfalls)

Are You Playing Catch-Up?

A catch-up provision adds a distribution tier to the equity waterfall, allowing the general partner (GP) to "catch up" with the limited partner's (LP's) profits. Partnership structures can take different shapes, and this is just one example of a catch-up provision.

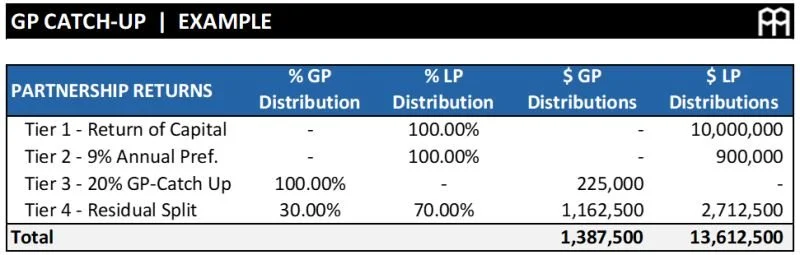

In the example pictured below, the LP is contributing 100% of the equity, totaling $10MM, and the waterfall is as follows:

•Tier 1 - Return of Capital: The LP first receives their initial $10MM investment back.

•Tier 2 - Preferred Return: The LP is then paid a 9% preferred return, which amounts to $900,000 (assuming a one-year hold).

•Tier 3 - GP Catch-Up: At this point, the GP is entitled to receive 100% of cash flow until they secure 20% of total profits distributed through this third tier. Since $900,000 of profit was distributed to the LP in tier 2, we now must determine what amount of profit the GP needs to earn so that the GP has 20% of total profits after this tier's distributions have been made. To calculate the total profit, divide the LP's profit in tier two by 1 minus the GP's catch-up percentage ($900,000/(1-20%)) which equals $1,125,000. Of the $1,125,000 total profit distributed through this third tier, 20% or $225,000, will go to the GP as their catch-up.

•Tier 4 - Residual Split: After the GP catch-up is satisfied, the remaining distributable cash flow is split 70/30 between the LP and GP.

Understanding these terms ensures clear expectations and transparency in profit-sharing between capital partners.